30 years ago, if you wanted to drive to a new city you had to be prepared with paper maps and actively read the road signs to make sure you were on the right path. If you were not accurate in reading the map or the road signs, then you would end up lost and making the walk of shame to the gas station attendant to ask for direction.

Elliott wave can be a similar tool to the paper maps of years ago. Elliott wave can describe the market’s twists and turns but if implemented incorrectly can lead you down the wrong road.

One way to learn how to prevent mistakes is to spot the mistakes of others.

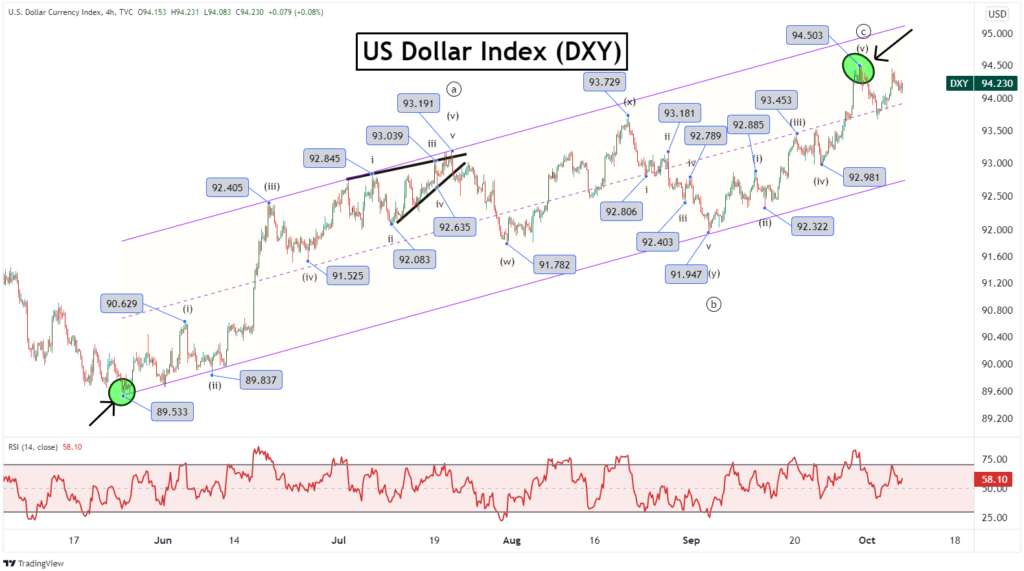

A few weeks ago, a version of this chart was shared asking for your thoughts on three deliberate Elliott wave labeling mistakes that were made on the chart.

I received many responses and several of them were correct! That indicates that you have a good eye on spotting Elliott wave labeling mistakes.

Perhaps there were a few of you who weren’t sure what the mistakes were.

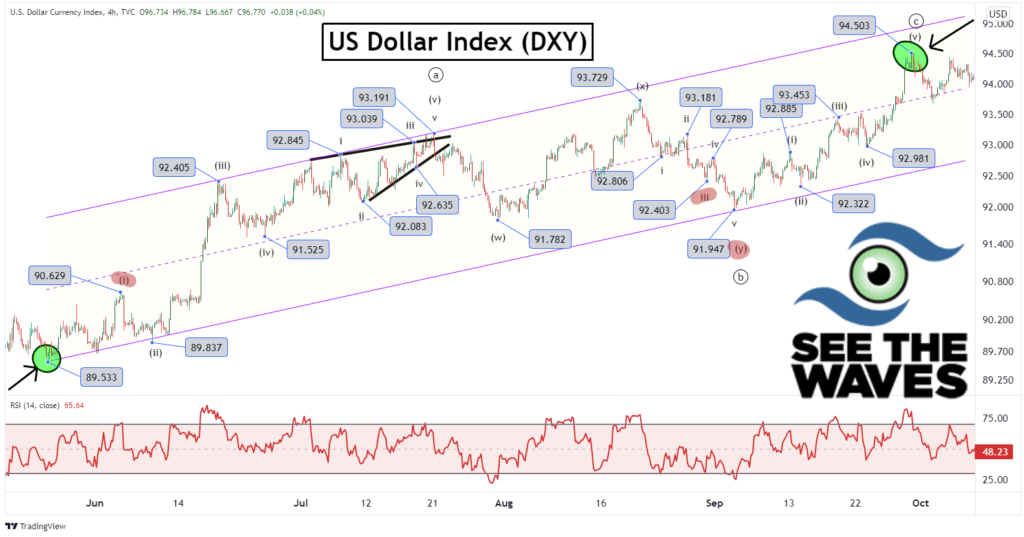

Here is the same chart with three red highlights pointing to the mistakes. Let’s unpack these mistakes now and what might be a better way to label them.

Mistake #1 – Missing the Extended Third Wave

Wave (i) clearly has a three-wave move higher. Since it is labeled as a number (1-2-3-4-5 or i-ii-iii-iv-v) this implies it is the first wave of a motive wave. A motive wave contains two patterns, an impulse or diagonal. Wave (i) will only contain a three-wave zigzag if the entire motive wave is a diagonal pattern.

When we look at the rest of the five-wave pattern, it clearly was not labeled as a diagonal. Therefore, something is wrong with this.

A better way to label this could be by incorporating an extended third wave. Shift wave (i) one swing high to the left and count out five waves for an extended third wave. Sure enough, immediately following our re-labeled wave (i), DXY rallies hard to the upside in what appears to be the third wave. Changing this labeling to an extended third wave makes sense here.

Let me pause for a moment.

I threw around some terms that you may not be familiar with. Terms such as motive wave, impulse pattern, diagonal pattern, zigzag pattern, and extended third wave. We fully explain these patterns with video lessons in our Elliott wave course. When you buy the course, you become a premium member which unlocks other benefits such as live webinars and your Elliott wave work reviewed by a Certified Elliott Wave Analyst.

Mistake #2 – Understanding the Structure of Double Three

Let’s focus on the red highlighted wave (y). A ‘Y’ wave is part of a (w)-(x)-(y) pattern. Both the (w) and (y) waves will be a-b-c patterns.

When we look at the subdivisions of wave (y), there is no corresponding a-b-c. In the incorrectly labeled chart, wave (y) subdivides as a five-wave trend i-ii-iii-iv-v which is incorrect. Wave (y) must be a-b-c.

What might be a better way to label this? Well, we first need to decide if the trend lower from 93.729 is a five-wave trend or a three-wave trend. To help answer that question, we need to continue with Mistake #3.

Mistake #3 – Wave 3 Cannot Be the Shortest

One of Elliott’s rules is that wave 3 cannot be the shortest of waves 1, 3, and 5. The third mistake is within this downtrend, wave iii is shorter than wave i and wave v. This break’s an Elliott wave rule implying there is another way to label this downtrend in late August.

The labeling of the late August downtrend was really messed up. To clean this up, we need to start by eliminating the trend as an impulse or diagonal pattern.

Generally, when you spot these situations, a double or triple zigzag is the labeling.

When re-labeling to a double zigzag, look for the largest interruption and corrective waves. That will help you spot the ‘X’ wave of the w-x-y.

In the example above, the largest corrective wave was towards the beginning of the downtrend. From there, look for a-b-c zigzags.

Now, the trend looks much cleaner as a double zigzag.

In Closing…

The changes we made above possibly alter the wave count from a bigger picture perspective. We’ll save that for another post as I didn’t want to overwhelm the traders new to Elliott wave.

There is no better way to learn Elliott wave than by doing. When you practice labeling, you will make mistakes. Having an Elliott wave expert looking over your shoulder and helping you see how to correct your mistakes will accelerate your understanding.

When you become a premium member of See The Waves, you will receive feedback on your Elliott wave labeling. Become a premium member today and unlock the plethora of benefits by purchasing our Elliott wave course.